The deadline for linking your PAN card with Aadhaar has been a source of confusion for many Indian taxpayers. While the general deadline passed in June 2024, the government has provided relief for specific categories of PAN holders. Understanding these extended timelines and the linking process can save you from penalties and ensure compliance with tax regulations.

If you applied for Aadhaar before October 1, 2024, and your PAN card was issued based on the same Aadhaar enrollment ID, you have been granted additional time. The government has extended the deadline until December 31, 2025, for such cases. This extension recognizes the administrative challenges faced by individuals whose documents were processed during the transition period.

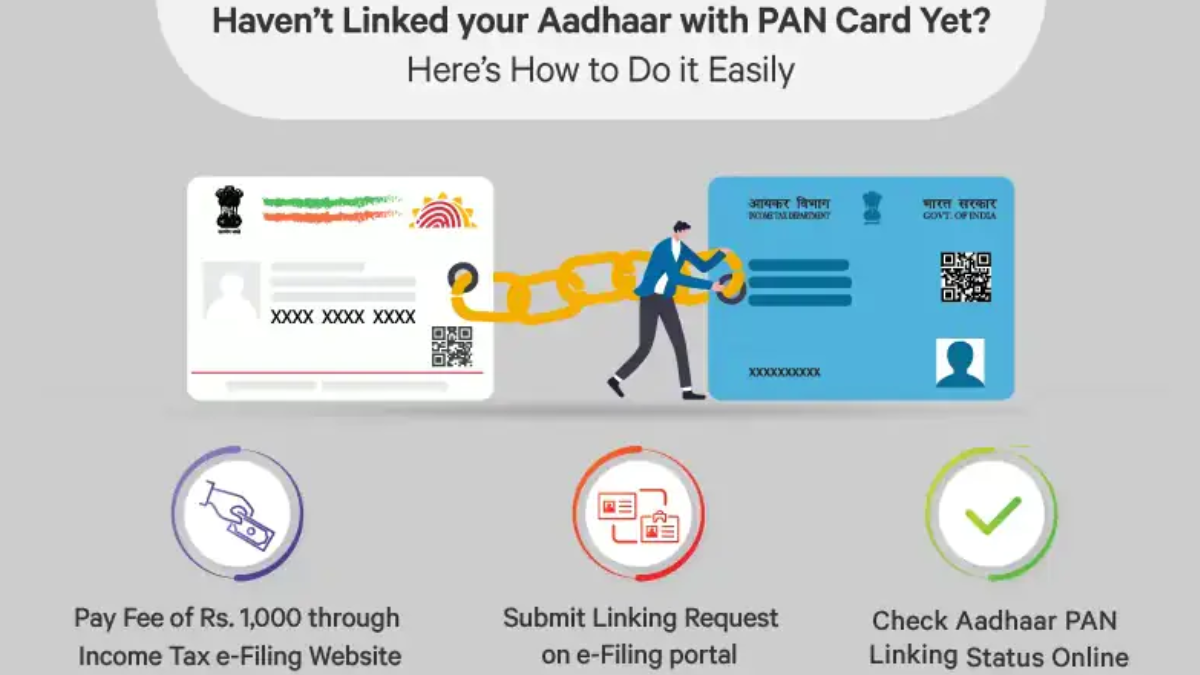

For all other PAN cardholders, the original deadline of June 30, 2024, remains unchanged. Those who missed this deadline must now pay a penalty of Rs 1,000 to complete the linking process. This penalty applies regardless of when you decide to link your documents after the deadline.

Who Gets the Extended Deadline?

The December 31, 2025 deadline specifically applies to individuals who meet two criteria. First, you must have applied for Aadhaar before October 1, 2024. Second, your PAN card must have been issued based on the same Aadhaar enrollment ID used in your original application.

This extension provides significant relief for new PAN holders who found themselves caught between changing regulations and processing timelines. The government recognized that many individuals faced genuine difficulties in completing the linking process within the original timeframe due to administrative delays.

If you’re unsure whether you qualify for this extended deadline, check your PAN application records. The enrollment ID used for your PAN application should match your Aadhaar enrollment details. When in doubt, it’s advisable to complete the linking process as soon as possible to avoid any complications.

Step-by-Step Online Linking Process

The online method offers the most convenient way to link your PAN with Aadhaar. Visit the official Income Tax Department website and navigate to the ‘Link Aadhaar’ section. You’ll need your PAN number, Aadhaar number, and the name as it appears on your Aadhaar card.

Enter your PAN number in the designated field, ensuring there are no spaces or special characters. Next, input your 12-digit Aadhaar number carefully. The system will automatically verify the details against the UIDAI database.

Provide your name exactly as it appears on your Aadhaar card. Any variation in spelling, including the use of initials versus full names, can cause the linking to fail. After entering all details, verify the information and submit your request.

The system will display a confirmation message if the linking is successful. You’ll receive an SMS confirmation on your registered mobile number. Keep this confirmation for your records, as it serves as proof of successful linking.

Offline Linking Through Service Centers

If you prefer offline processing or face technical difficulties with the online system, visit any NSDL or UTIITSL service center. Carry original copies of both your PAN card and Aadhaar card, along with photocopies of each document.

Request the ‘Annexure-I’ form at the service center. This form requires basic information including your PAN number, Aadhaar number, and personal details. Fill out the form carefully, ensuring all information matches your original documents exactly.

Submit the completed form along with your document copies to the service center representative. They will verify your details and process the linking request. You’ll receive a receipt with an acknowledgment number for tracking purposes.

The offline process typically takes longer than online linking, often requiring several days for completion. However, it provides an alternative for individuals who cannot access online services or prefer in-person assistance.

Common Issues and Solutions

Name mismatches represent the most frequent cause of linking failures. Even minor differences like “Kumar” versus “Kumr” or variations in surname order can prevent successful linking. Before attempting to link, carefully compare the names on both documents.

Date of birth discrepancies also cause linking problems. If your PAN and Aadhaar show different birth dates, you’ll need to correct one of the documents before proceeding. Gender information must also match exactly between both documents.

If your linking request gets rejected due to data mismatches, you have two options. You can either update your Aadhaar information through the UIDAI website or correct your PAN details by contacting the Income Tax Department. Choose the option that involves correcting the document with incorrect information.

Missing or incorrect mobile number registration can also cause issues. Ensure your mobile number is updated in both PAN and Aadhaar records, as confirmation messages are sent to this number.

Penalties and Consequences

The Rs 1,000 penalty applies to all PAN holders who missed the original June 30, 2024 deadline and don’t qualify for the extended timeline. This penalty must be paid before completing the linking process.

Beyond the immediate penalty, unlinked PAN cards may face restrictions. The Income Tax Department can reject tax returns filed with unlinked PAN cards. Additionally, certain financial transactions may be limited or subject to higher tax deduction rates.

Banks and financial institutions often require linked PAN-Aadhaar for various services. Unlinked documents may prevent you from opening new accounts, applying for loans, or conducting high-value transactions.

Regular reminders and notices from the Income Tax Department will continue until you complete the linking process. These communications serve as formal notices and maintaining compliance helps avoid future complications.

Take Action Before It’s Too Late

The extended deadline until December 31, 2025, provides valuable breathing room for eligible PAN holders. However, waiting until the last minute isn’t advisable. Technical issues, documentation problems, or system maintenance could create delays that push you past the deadline.

If you qualify for the extended deadline, gather your documents and begin the linking process now. For those who missed the original deadline, pay the penalty and complete linking immediately to restore full functionality to your PAN card.

Regular checking of your linking status ensures any issues are identified and resolved promptly. The Income Tax Department’s website provides a status-checking facility where you can verify whether your documents are successfully linked.

Keep digital and physical copies of your linking confirmation. This documentation proves compliance and helps resolve any future disputes about your linking status.

FAQs: Frequently Asked Questions

1. What is the new deadline to link PAN with Aadhaar?

The new deadline for linking PAN with Aadhaar has been extended to December 31, 2025.

2. Who is required to link PAN with Aadhaar?

All individuals possessing a valid PAN and who are eligible to obtain an Aadhaar must complete the linking process, except for entities specifically exempted by the government.

3. What happens if I don’t link my PAN with Aadhaar by the deadline?

Failure to link your PAN with Aadhaar by the deadline may render your PAN card inoperative. Additionally, you may face a penalty of up to Rs 1,000 for non-compliance.

4. How can I check if my PAN and Aadhaar are linked?

You can visit the official income tax e-filing portal to check your linking status by entering your PAN and Aadhaar details.

5. Do NRI or foreign citizens need to link PAN with Aadhaar?

No, Non-Resident Indians (NRIs) and foreign citizens are exempt from linking their PAN with Aadhaar.

6. Is there a fee for linking PAN with Aadhaar?

Yes, a nominal fee of Rs 1,000 is required to process the PAN-Aadhaar linking request if done after the initial deadlines set by the government.

7. Can I link PAN with Aadhaar offline?

Yes, you can also visit an authorized service center or facilitation center to link your PAN with Aadhaar offline.

For further questions or assistance, consult the official guidelines provided by the Income Tax Department or reach out to their helpline.

For More Information Click HERE